Your Trusted Partner

We are your personal professional partner for helping you achieve financial freedom

and a life of abundance. Specializing in financial investment, we are dedicated to

helping businesses and individuals unlock their full financial potential in today’s

ever-evolving financial landscape.

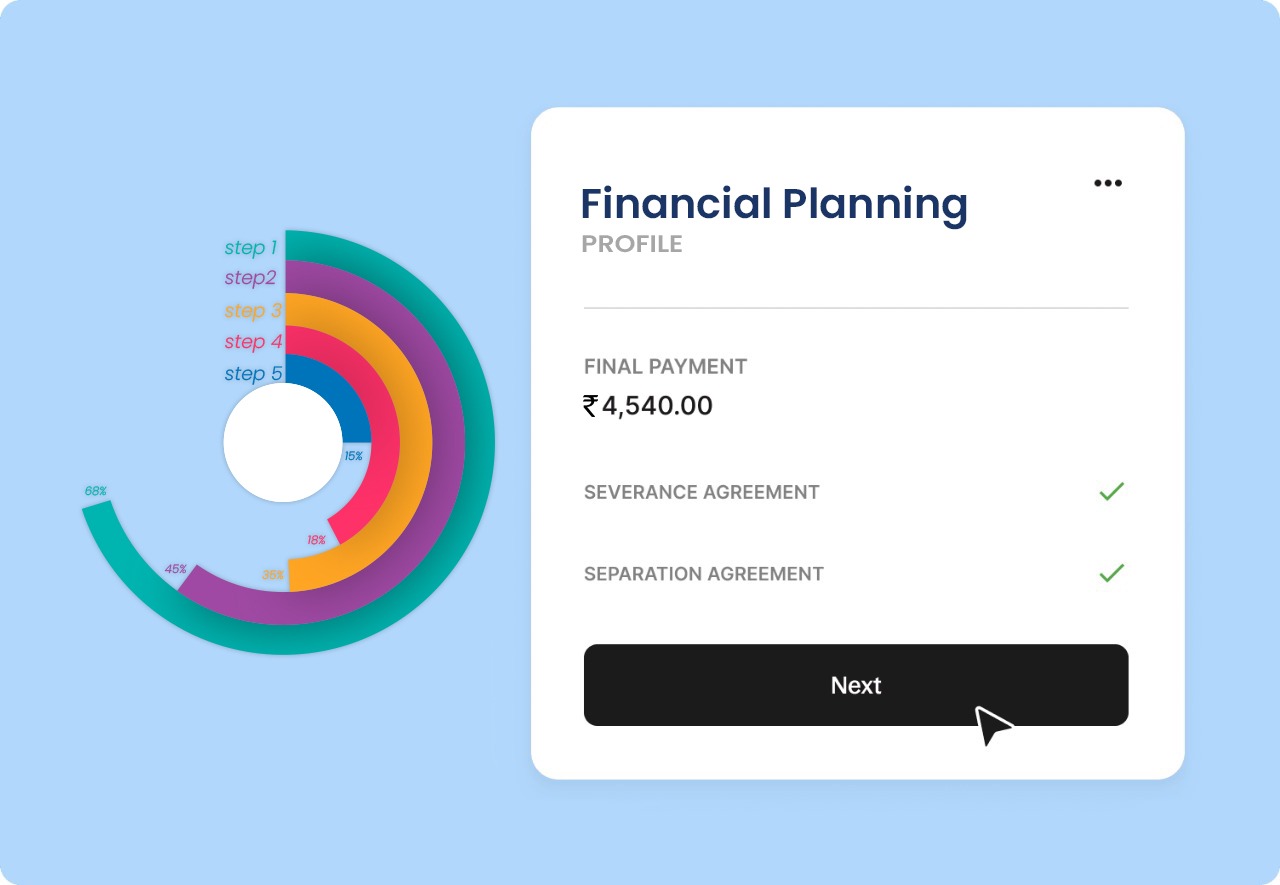

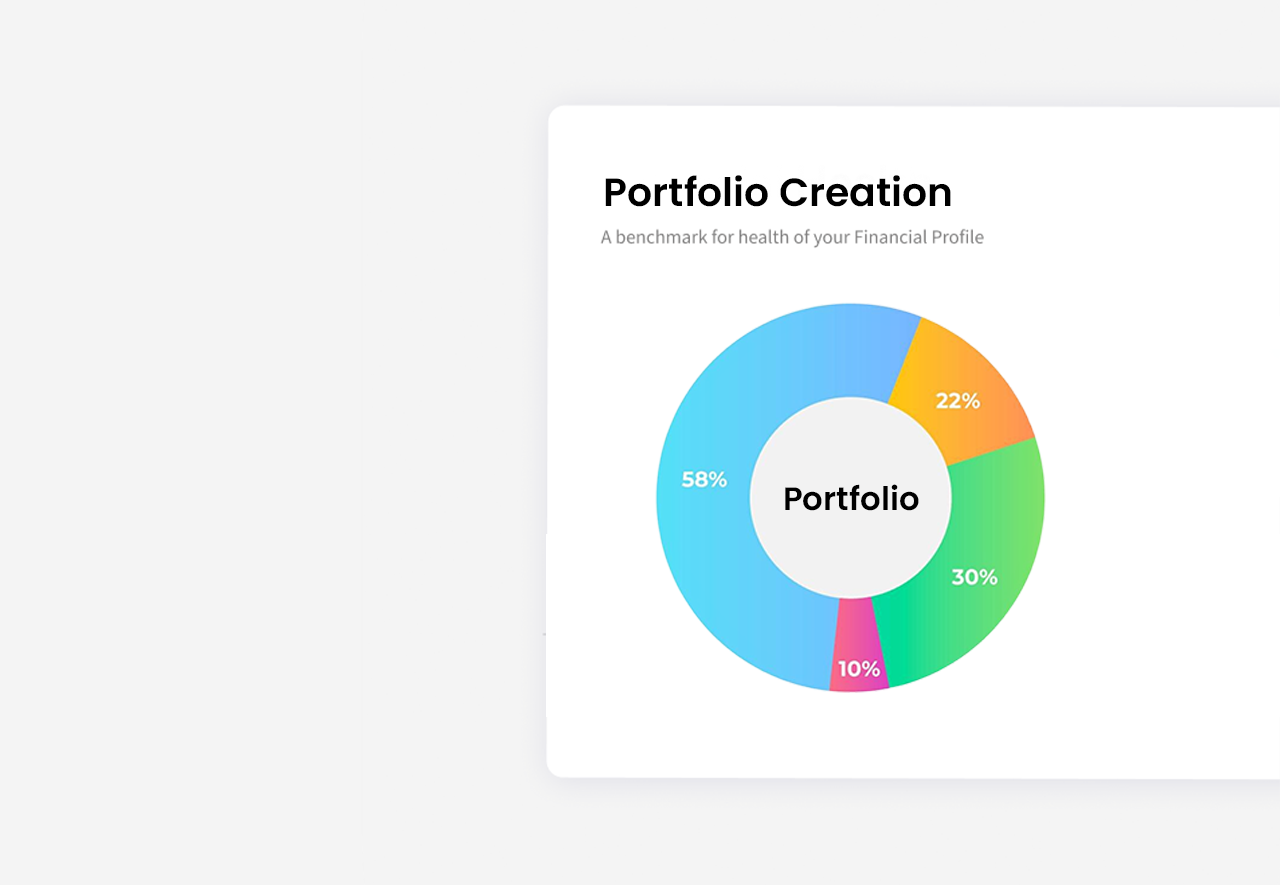

With a wealth of industry expertise, we deliver comprehensive advisory services designed

to empower you to optimize financial performance, mitigate risks, and achieve lasting

growth.

Whether you aim to grow wealth, plan a secure retirement, or manage corporate

investments, we partner with you to design a strategy that not only meets your goals but

also transforms your financial dreams into reality. Let us help you take control of your

finances, embrace abundance, and live a life on your terms.